About

DCVC is deep tech venture capital.

It always has been. Over more than a dozen years, we’ve backed brilliant entrepreneurs using computational approaches to solve trillion-dollar problems in the real world across a broad set of industries, especially those that haven’t seen material progress in decades.

With billions of dollars of assets under management, we build long-term relationships with the founders we back. We’ve been with many of our companies from their very start — and through to their recognition by the public markets as category-defining businesses.

We are structured to have the greatest impact possible.

Data Collective Founders and Managing Partners Matt Ocko and Zachary Bogue lead our franchise, which comprises 13 funds to date.

DCVC backs entrepreneurs solving trillion-dollar problems to multiply the benefits of capitalism for everyone while reducing its costs.

Our six flagship funds find, fund, and grow companies that use AI to enable entrepreneurs to tackle giant real-world problems cost effectively. These funds’ investment team brings to bear exceptional operational and investment expertise in AI, exa-scale computing, climate, engineering, materials science, robotics, space, water, biology, defense and security, and more.

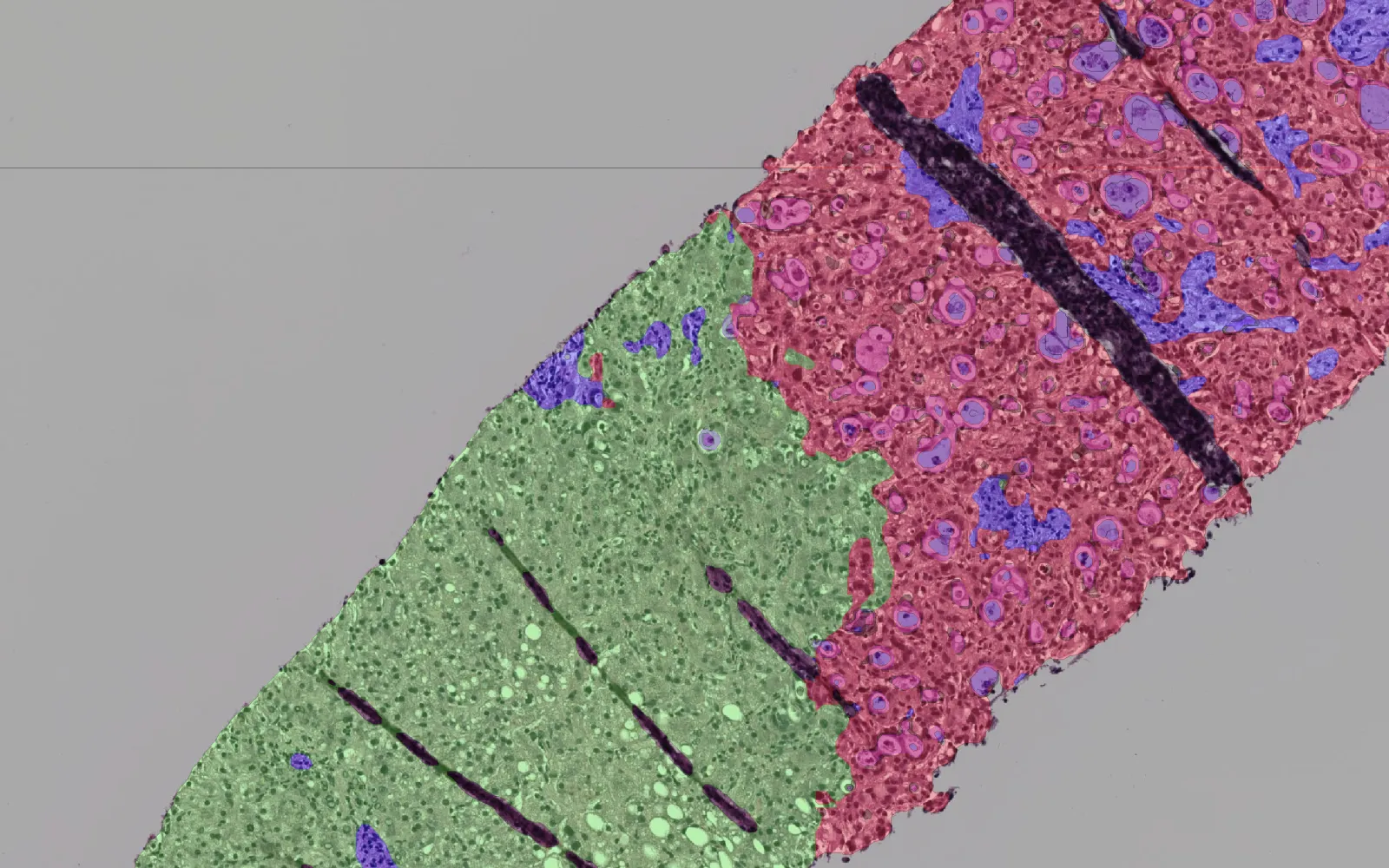

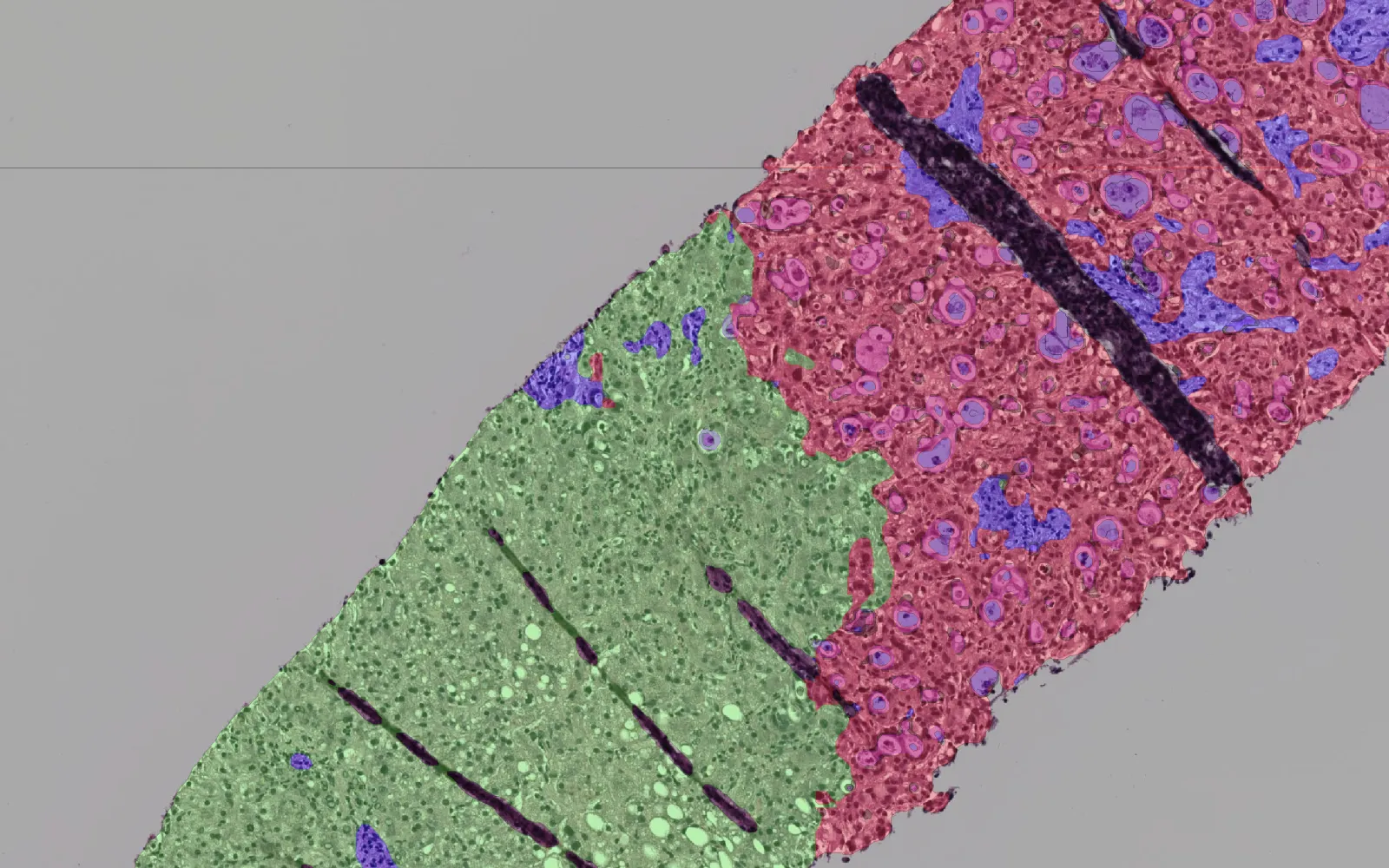

In 2018, recognizing both the vast promise of computational biology and the long experience required to bring medicines to the clinic or commercialize new life sciences products, we established DCVC Bio, co-founded by its four Managing Partners Dr. John Hamer, Dr. Kiersten Stead, Matt, and Zack. Together, they have formed an investment team that applies a deep understanding of genetics, chemistry, molecular biology, agriculture, industrial fermentation, and AI to DCVC Bio’s three funds.

Across funds and teams, we are obsessively focused on deep tech, and are open to the full breadth of its possibilities. Working with our company founders and investors, we’ve created tens of billions of dollars of value while also making the world a better place.

We are in a hurry to do things that take time.

We have one of the longest records of climate tech investment of any VC firm in the world, and we are committed to intensifying that effort until the existential problems surrounding the climate are solved. We have bold ambitions in human health: DCVC Bio backs companies devoted to curing now untreatable diseases and to feeding nutritiously and sustainably everyone on the planet. And we want to automate and transform dirty, dangerous industries where the demand for labor vastly outstrips the number of willing workers, because those are jobs humans don’t like and don’t want.

We believe that done right, venture capital improves the common good.

We have more published scientists than MBAs, and most of us have founded or run successful companies. We draw on a wide network of people with exceedingly rare combinations of operational and technical depth. The founders we support have sky-high ambition that demands the right introductions and resources at the right times. We make them and have them.

-

$4bAssets Under Management

-

45Team Members

-

13Years Active

-

200+Companies invested in

Our work is serious. It is also fun.

We still read code. We understand chip architecture, and we know the difference between MERFISH and metagenomics. We’ve built supercomputer racks ourselves, and we know that degrees of freedom doesn’t mean how often a robot escapes. We appreciate that Grover’s Algorithm wasn’t written for a quantum version of Sesame Street, and that Specific Impulse isn’t a new fragrance.

We will be there at 3 A.M. to cheer the new stable build or at 7 A.M. to help land that new customer. We take the nervous phone call when things feel bleak or scary and know that the risk of failure always attends bold endeavors. We want to be useful to some of the most important people in the world. That is what we live for.

Deep as deep tech dares to go, we operate at the intersection of capital and imagination. If you dream without illusion, we welcome your interest in our work.

Recent Posts

DCVC DTOR 2025: One overlooked source of clean water is polluted water

DCVC DTOR 2025: For the environment and for our health, we must learn to produce more food, more efficiently