StarkWare

Bringing security, scalability, and privacy to the blockchain

The DCVC Deep Tech Opportunities Report (which debuted this year) summarizes our thinking about nine of the deep tech investment areas we consider the most exciting, important, and consequential. It’s a guide to the inspiring work innovators inside and outside the firm’s portfolio are doing to extend human capabilities, save the environment, and make everyone’s lives longer, healthier, and easier. It also covers three additional focus areas where DCVC is monitoring the latest innovations and placing careful bets. This is one of them.

The internet was made safe by three critical waves of security innovation. The first came in the early 1990s with the invention of firewalls that protected private networks by restricting the movement of data in or out of the networks. Soon after, companies like Netscape and Verisign introduced Secure Sockets Layer certificates (succeeded by today’s Transport Layer Security certificates), which used public-key encryption to authenticate web servers and other devices; this second wave ended up powering the commercial internet, from Amazon to healthcare portals to e‑government. The third wave, being implemented today, is an upgrade to the infrastructure of trust — using blockchain and other techniques to ensure data integrity without compromising privacy.

When you hear the word “blockchain,” you may think immediately of blockchain-based cryptocurrencies like Bitcoin. And it’s true that blockchain technologies have opened up new avenues for financial innovation. But because cryptocurrency markets are decentralized and largely unregulated, it’s too easy for unscrupulous operators can abuse the trust of their investors or business partners. That’s why DCVC is focused on innovation in cryptography, not in cryptocurrency. Companies in our portfolio are exploiting the blockchain, other fundamental cryptographic principles, and ideas from algorithmic finance to increase transparency and efficiency and reduce costs in critical areas of science and commerce — all in the service of creating equitable economic opportunities and new business models.

StarkWare, backed by DCVC since its 2018 Series A funding round, is an example. The company’s cofounder and president, Eli Ben-Sasson, co-invented zero-knowledge scalable transparent arguments of knowledge, or ZK-STARK, a method for verifying the integrity of confidential, encrypted data without slowing blockchain-based markets to a crawl.

A zero-knowledge proof is a way to demonstrate the validity of a statement without revealing anything about the statement itself, and the idea has applications in fields as critical as nuclear disarmament, where it can be used to tell real warheads from spoofs without opening the devices to tampering or snooping. StarkWare is using it to overcome a limitation in first-generation cryptocurrencies such as Bitcoin. While Bitcoin funds are tied to pseudonymous addresses, not named individuals, every Bitcoin transaction ever completed is visible in its blockchain — meaning Bitcoin is anonymous but not private. Newer protocols such as Ethereum allow for the storage of hashed or encrypted data and transactions, but it takes a lot of computational power to verify that a hashed dataset is what its owner says it is. The ZK-STARK technique ensures privacy by shielding the inputs that go into a proof-of-integrity computation. And it solves the scalability challenge by vastly reducing the amount of computation needed to verify a batch of transactions.

StarkWare is building a set of tools that make it easy for developers to use ZK-STARK proofs on the Ethereum platform. One, called StarkNet, is a service that validates batches of transactions using ZK-STARK proofs before they’re added to the Ethereum blockchain. Visa used it to test a way for citizens of multiple countries to make recurring payments automatically, essential for young businesses around the globe to make payments to their supply chain and to regulators. Another is StarkEx, an architecture for decentralized exchanges of value, including intellectual property. StarkEx enables huge numbers of stakeholders to seamlessly rendezvous and exchange this value, with zero fraud. We see it as this decade’s Verisign — a breakthrough in how large groups of people can trust each other.

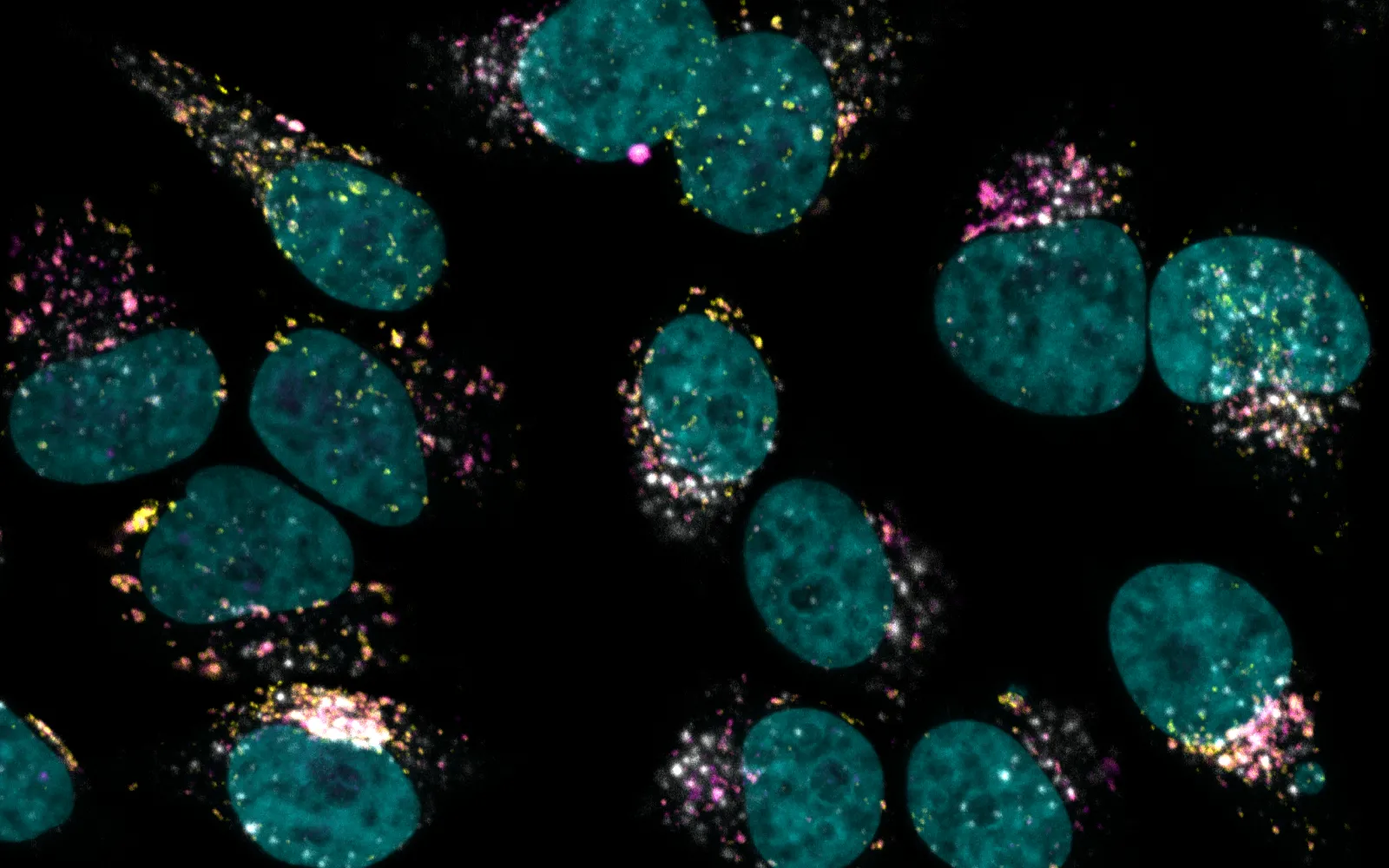

A DCVC-backed company called DVLP Medicines is using blockchain technology to reinvent another essential function of our economy: the creation of new medicines. As more microbes evolve ways to evade our current antibiotics, there’s a desperate need for a new generation of antimicrobial compounds. Yet such drugs don’t usually command high prices, which gives Big Pharma few incentives to shepherd them through the risky, multiyear, multibillion-dollar process of getting from the lab bench to FDA approval.

DVLP’s cofounder and CEO, Jason Paragas, argues that the process doesn’t have to be so costly, and that traditional drug-development organizations are weighed down by too many layers of overhead. What’s needed, he believes, is a way for investors to back specific drug candidates, rather than the companies around them. Inspired by the “payment rails” used by banks to track and verify digital money transactions, DVLP is creating a blockchain-based system that will allow drug developers to securitize specific antimicrobial molecules and other drugs with clinical promise. Because modern blockchains can incorporate smart contracts, the value of these securitized drugs will automatically adjust when the programs reach agreed milestones, such as proof of nontoxicity or a positive Phase I trial result.

And there are many other markets where transactions can be sped up, or opened up, through algorithmic thinking. “We believe in a future where many assets are tokenized,” says DCVC general partner Ali Tamaseb. Kettle, for example, is updating the way the insurance industry uses statistical modeling to understand and price risk. The company’s convolutional neural networks analyze weather data, vegetation, topography, building design, and other factors to predict where wildfires will start and how much damage they might cause. That allows Kettle to understand fire risk at a more granular level and offer insurers cheaper reinsurance. Tala does something similar in the world of small-business lending, using data from smartphones to assess creditworthiness and deliver automated loans to small business owners in Mexico, Kenya, the Philippines, and India.

In the end, DCVC’s cryptographic companies are all developing smarter infrastructure, whether they are enhancing trust and safety, atomizing drug development, or finding better ways to model risk in insurance and lending. “You’re using data to make the flywheel go faster, to build better models, to understand something better,” says Tamaseb. “That’s the deep tech lens.”

Bringing security, scalability, and privacy to the blockchain

Creating a software co-pilot for drug development and a new marketplace for investors and outsourced R&D and manufacturing

Helping the insurance industry understand and price wildfire risk

Digital financial services for the underbanked