Alta Resource Technologies

Using advanced biochemistry to create a secure supply of critical minerals from waste and other low-grade sources

The 2025 edition of the DCVC Deep Tech Opportunities Report, released in June, explains the global challenges we see as the most critical and the possible solutions we hope to advance through our investing. This is the report’s opening essay.

In terms of the value added to global GDP by its manufacturing sector — that is, the value of outputs, minus the cost of inputs — the U.S. ranks second in the world, surpassed only by China. “People don’t realize that the United States is, in fact, a leader in manufacturing,” says Zachary Bogue, co-founder and managing partner at DCVC.

But if we want to make the competitive products and services that Americans and the world will want to buy in the future, while also sparing the environment and creating plenty of high-paying jobs, we can’t ease up on efforts to modernize and decarbonize U.S. manufacturing. Nor can we remain dependent on strategic adversaries like China for affordable consumer goods or critical metals and minerals. The challenge now is to expand on our existing industrial base and bring home our most important supply chains, while at the same time shrinking our overall carbon footprint, undoing environmental damage, making our population healthier, and protecting against adversaries.

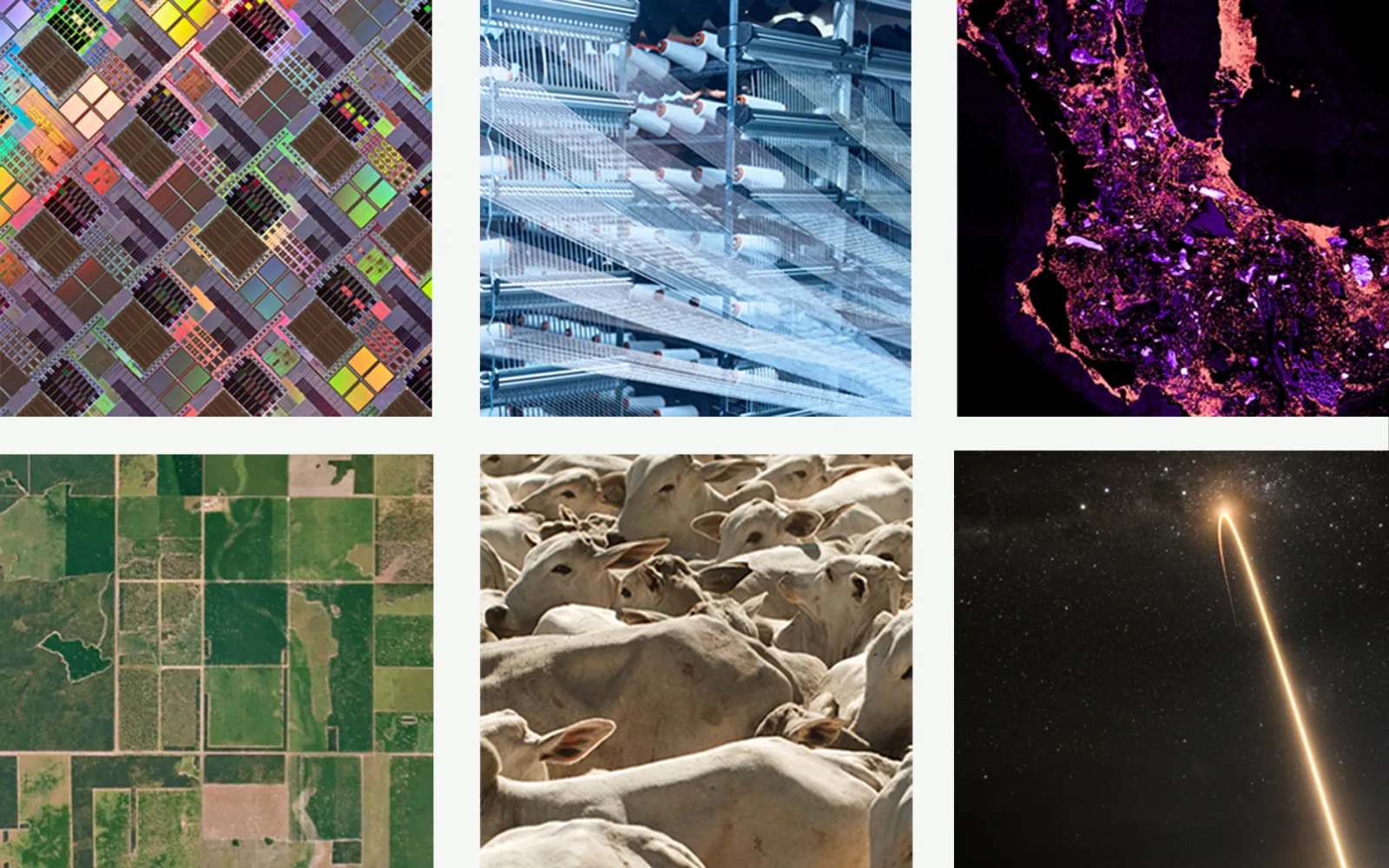

Engineering this kind of smart expansion will require innovations across multiple technologies:

In other words: deep tech of the kind DCVC has long championed using the $4 billion in venture funds we manage.

Each annual edition of this Deep Tech Opportunities Report seeks to describe in broad terms what we see as the most obviously attractive and interesting deep tech investment areas. This year, that’s the prospect of an American industrial renaissance — one that is intertwined with, and indeed accelerated by, efforts to improve the environment. Here at DCVC we believe that private capital and the expertise that the best venture capitalists bring can help spark the required breakthroughs, eventually bringing about the kind of abundance and resilience we’ve written about in previous editions of this report. In short: Deep tech innovation has never been more important for the future of the planet and the security and prosperity of the U.S. and its allies.

As you read this year’s report you’ll see us emphasizing and elaborating on three major trends:

One, obviously, is the role deep tech companies are playing in the reinvention of American industry. They’re rethinking manufacturing methods, transportation and logistics, resource extraction and recovery, and many other areas in order to help American companies build and deliver better, higher-value products at lower expense.

The second inescapable trend is the growing importance of computation and artificial intelligence — in particular, foundation models cast in the same mold as the large language models being built by OpenAI, Google, and Anthropic, but trained on highly curated, proprietary data. These models now figure in almost everything deep-tech companies are doing, from building and programming robots to making farms more sustainable to reinventing drug development.

Third, we see an inextricable link between deep-tech innovation that bolsters American resilience and innovation that saves the environment. In many ways, they are one and the same. The reality, of course, is that there is no time left to put off the major reductions in greenhouse gas emissions that will be required to slow and eventually stop global temperature increases. Fortunately, smart reindustrialization helps to slow emissions. Reshoring that shortens supply chains and circumvents the wasteful and polluting practices of traditional trading partners is inherently planet-friendly. “Pretty much everything in advanced manufacturing also falls into the bucket of decarbonization,” says DCVC general partner Milo Werner. On top of that, renewable and sustainable energy technologies are simply a better investment than fossil fuel – based alternatives. Properly understood, these are areas of common ground between political factions, where entrepreneurs and leaders can work together to create better jobs and a cleaner, more habitable environment.

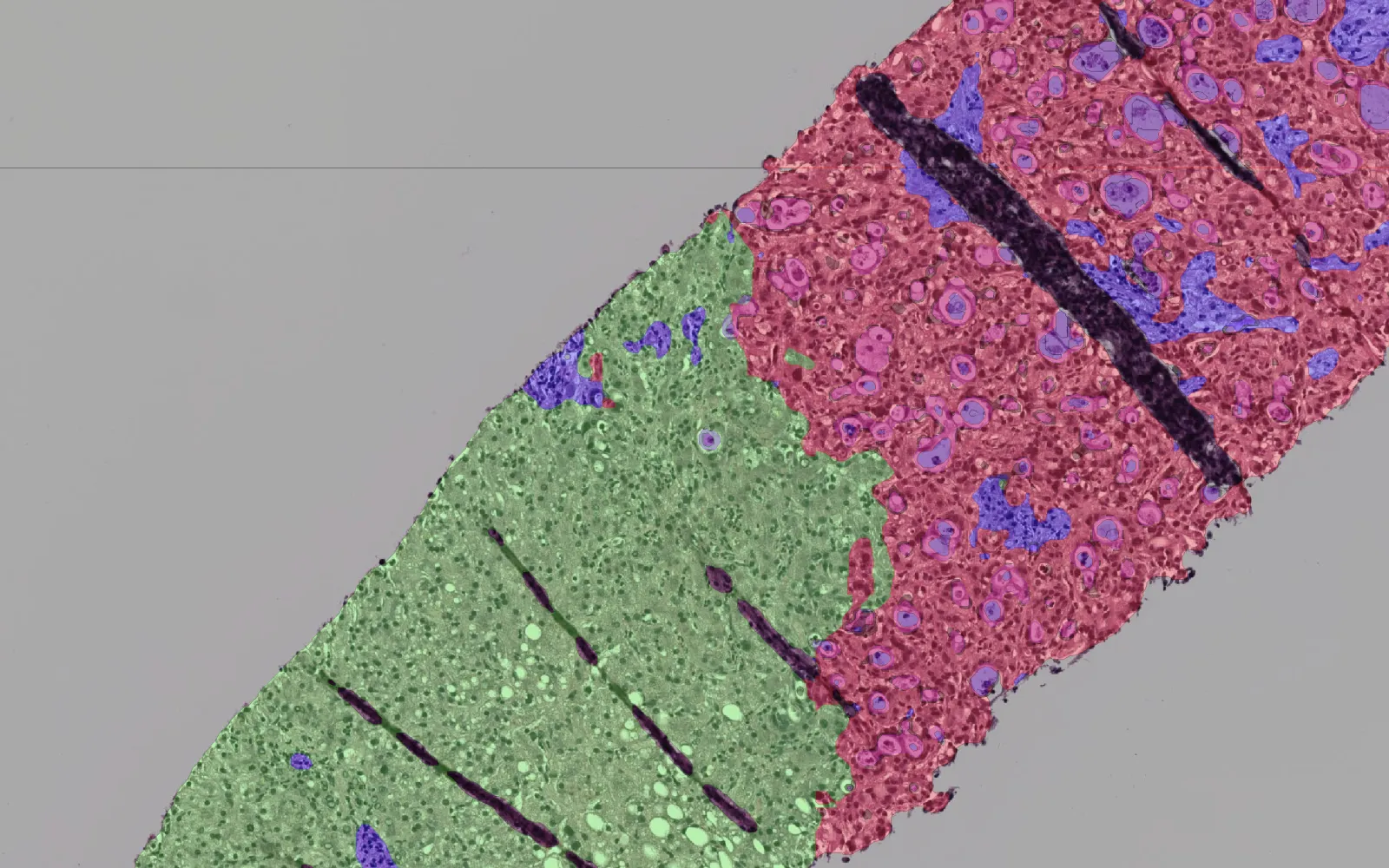

We think these three overarching trends overlap and reinforce one another, and when we invest we often look for companies tapping into them in novel, transformative, defensible ways. Alta Resource Technologies, one of our newest portfolio companies, is a prime example. The company uses computationally optimized proteins to efficiently latch onto and recover rare earth elements from e‑waste— with the goal of creating a U.S.-based supply chain for critical minerals that are currently imported from China.

Another example is Relation Therapeutics, a drug discovery company working to treat osteoporosis, fibrosis, and other complex diseases. The company uses genomic and transcriptomic data from human cells to train AI models that help researchers predict which genes and proteins contribute to disease processes. In the lab, it observes how knocking out these genes affects cell function, generating more data that points to biological pathways that could be targeted with drugs. In the largest-ever deal for a seed-stage TechBio company, pharmaceutical giant GSK recently offered hundreds of millions of dollars in milestone payments for the right to develop drugs based on Relation’s findings.

A point we hope is clear from this year’s report is that computation feeds into smarter product design, which builds new industries that solve challenges in health, manufacturing, and climate, earning high profits that can in turn be reinvested in more computation and a revitalized infrastructure. “You can have your cake and eat it too,” says DCVC co-founder and managing partner Matt Ocko. “You can have prosperity and resilience — and you don’t have to be a caricature of a nineteenth-century robber baron to do it.”

Our strategy at DCVC has always been to steer away from the frothy, the faddish, and the fashionable and invest instead in deep tech companies with new, proprietary, computationally accelerated ways to solve the hardest, most urgent science and engineering problems. Today, more than ever, that strategy is proving profitable, for us, our limited partners, and our portfolio companies. We hope that you’ll find inspiration in the stories in this year’s report — and that if you haven’t yet joined us in these critical efforts, you soon will.