DCVC announces $1 billion in fresh funding; releases inaugural DCVC Deep Tech Opportunities Report

A decade and a half into our work backing deep-tech founders solving the hardest real-world problems computationally, we are pleased to announce having just raised more than $1 billion in fresh capital and also the release of the inaugural DCVC Deep Tech Opportunities Report, our partnership’s views on the current state of deep-tech innovation.

From its founding, DCVC has asked a specific question: How can the leading edge of computing be married to emerging capabilities in materials science, biology, chemistry, and other physical domains to bring humanity greater resilience, abundance, and equitability? The answer to that question has presented an ever-evolving set of opportunities across industries.

If our firm was born of the hunch that this was the right question, it has grown through evidence that those who dream without illusion — entrepreneurs who unite technical ambition with operational pragmatism — merit venture capital investment.

More than $1 billion in fresh funding for DCVC’s next chapter

DCVC’s insistence that we back companies with a competitive advantage rooted in AI or computing innovation led to early successes with scale-out technology that was the prerequisite to making today’s deep tech investments capex- and opex-feasible: DCVC portfolio companies became the building blocks of AWS, Microsoft Azure, Google Cloud, Illumina, and VMWare. (And just last month, DCVC-backed Databricks announced the acquisition of DCVC-backed MosaicML for over a billion dollars in a resounding victory for accountable, explainable, high-quality generative AI.)

As the power of computing grows, so does the breadth of what it can achieve. In following that trajectory closely, DCVC became unusual for backing companies that apply cutting-edge new abilities in computing to hard, physical, often dirty and decades-old problems in every imaginable domain. Across climate, industrial infrastructure, defense, human health, and more, while our companies’ technologies are often difficult to explain, their benefits are clear and profound:

- Climate: Pivot Bio reprograms soil microbes to produce nitrogen sustainably, offering a substitute to the massive amount of synthetic nitrogen fertilizer currently used by farmers around the world, whose production, bulk transport, and use is responsible for more than 5% of GHG emissions and whose use pollutes our oceans and rivers. ZwitterCo’s use of zwitterionic polymers prevents membrane fouling, enabling its customers to filter the world’s toughest “unfilterable” wastewater. CH4 Global’s feed supplement for cows could save the world an additional 6% of GHG emissions, while the Insight M aerial platform pinpoints methane leaks for the oil and gas industry: its reported 2022 impact was 5X greater than Tesla’s in terms of avoided CO2 equivalent.

- Energy: Fervo Energy, which plans to put power on the grid this year, is poised to lead a renaissance in geothermal energy; Oklo—which just announced it is going public — wants to do the same for nuclear power; and Zap Energy offers a promising approach to fusion power.

- Materials: Twelve just broke ground on its first commercial plant for sustainable aviation fuel made from CO2. Brimstone is the first and only company that can make CO2-negative Ordinary Portland Cement, and they just received official ASTM certification for it. This matters: cement is responsible for 8% of global CO2.

Were the companies mentioned above to reach their full potential, a great proportion of the world’s GHG emissions could be eliminated — and we’d be eating more abundant, sustainably raised food, and drinking cleaner, more plentiful water, without politically fraught new regulations or passing on costs to hardworking people in any country, rich or poor.

- Defense & Aerospace.: Other DCVC companies are protecting democracy against reemerging threats. Fortem Technologies’ DroneHunters are in Ukraine right now, shielding that country’s civilians and armed forces against Russian and Iranian suicide drones. Capella Space’s synthetic aperture radar satellites (often launched by DCVC-backed Rocket Lab) collect high-resolution, 24⁄7 imagery of any location on the planet at night and through clouds: a critical need for national defense (as well as for commercial and ecological applications). And Primer uses natural language processing algorithms to help analyze unstructured data from multiple sources in multiple languages to help those responsible for security stay ahead of geopolitical crises, cyberattacks, disinformation, and other threats. Planet’s constellation of over 200 satellites scans the Earth’s entire landmass every day, generating data that helps farmers increase crop yields, regulators slow deforestation, insurers and investors map and monitor assets, and governments manage emergencies and security threats.

- Robotics. Agility Robotics’ first and only warehouse-ready, safe, bipedal, fully autonomous, human-centric, multi-purpose robot made for logistics work is scaling to augment human labor at warehouses and distribution centers around the U.S. Fulfil is delivering robotic platforms that fit in spaces as small as an urban brownstone and that can enable fast, healthy, and fresh grocery delivery anywhere in the US and EU — profitably for the grocer and at low cost for families. This can have a massive impact on food waste and related GHG emissions and can help end food deserts in a wide range of communities.

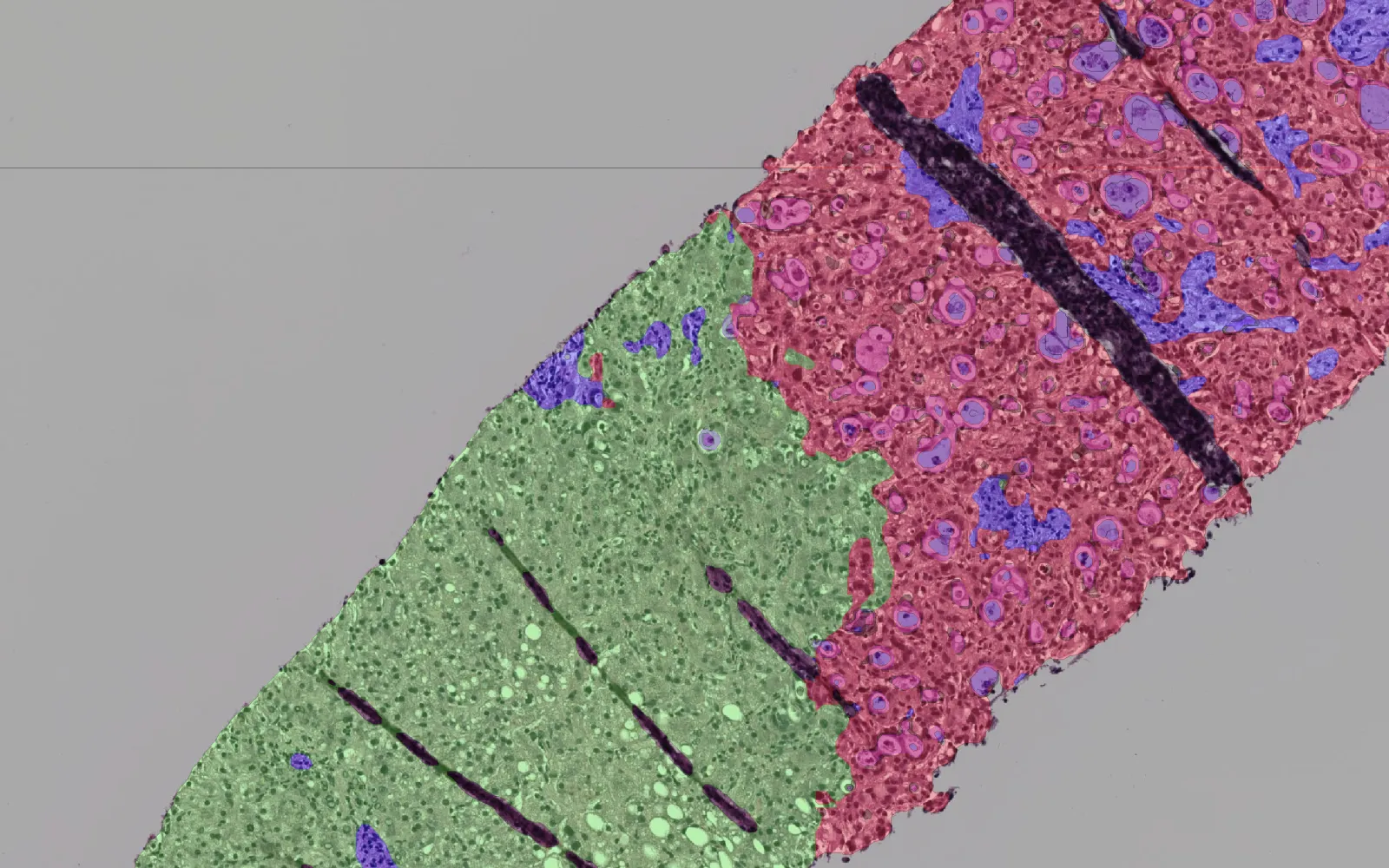

In 2018, DCVC began addressing an even broader range of global challenges with the launch of DCVC Bio, which we co-founded with Dr. John Hamer and Dr. Kiersten Stead, who bring rare, differentiated experience in deep-tech biotech investment, and who were previous LPs in DCVC’s first crop of funds through Monsanto Growth Ventures. DCVC Bio’s three funds pursue the vast promise of AI-enabled life sciences platforms to bring medicines to the clinic and commercialize an industry-spanning array of biological breakthroughs. AbCellera (Nasdaq: ABCL) developed the first COVID-19 antibody treatment and several ground-breaking successors, and novel biopharma companies like Chroma and Totus (among others in our portfolio) are approaching drug development in compelling, novel ways. Sabanto is a leader in autonomous farming, and MycoWorks makes a beautiful, durable, sought-after alternative to leather from mycelium.

Investing successfully across the full breadth of deep tech requires people of uncommon experience, talent, and drive. We believe our flagship funds’ investment team brings exceptional operational and investment acumen in AI, exa-scale computing, climate, engineering, materials science, robotics, space, water, biology, defense, security, and more. And our DCVC Bio team brings equally strong know-how in genetics, chemistry, molecular biology, agriculture, industrial fermentation, and AI. We often work across teams to vet, invest in, and support the extraordinary companies in our portfolio.

DCVC seeks to deploy capital behind companies that will reshape their industries. This year, we decided to give public expression to our view of where opportunities are best sought in deep tech: a report from the front, as seen by our partnership.

Introducing the DCVC Deep Tech Opportunities Report

We organized our inaugural edition around three domains central to deep tech, and that drive many of our current investments: Augmenting Human Abilities, Climate Tech, and Computational Biology & Health. Within each, we outlined three areas of innovation and entrepreneurship poised to have the biggest impact in the near future. For each domain, we also shared at least one doubt — a skeptical observation about a much-hyped technology that could turn out to be critical to humanity’s future, but which is probably not ready for venture-scale growth or investment.

The result is a 96-page report covering human-centric robotics, machine vision, large language models, water, the electrification of everything, nuclear power, predictive drug development, and biological mimicry. We also discuss three more focus areas we think will be transformational: carbon-intelligent materials, space, and cryptography for the real world.

The report is emphatically not an exhaustive survey of DCVC’s portfolio. We invest in many companies outside of this year’s three domains, and in future reports we will have more to say. Nor does it focus solely on our portfolio — we discuss many companies leading in their respective fields that aren’t backed by DCVC. For now, we invite you to download the report and read our thinking about the deep tech realms we consider most promising.

It’s our absolute privilege to back our portfolio companies. We are deeply proud of the work they are doing — and eager to back the next generation of deep tech breakthroughs. We can’t wait to put our freshly raised funding to work.

Matt Ocko and Zachary Bogue are the Co-Founders and Managing Partners of DCVC.

This post is provided solely for informational purposes and should not be relied upon as investment advice or construed as an offer to provide investment advisory services. This post does not constitute an offer to sell or a solicitation of interest to invest in any pooled investment vehicle managed by DCVC. Investments referenced are not representative of all prior DCVC investments and there can be no assurance that the investments referenced will be profitable or that future investments will have similar characteristics or results. This post may contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended. Because forward-looking statements involve risks and uncertainties, actual results may differ materially from expectations or projections made or implicated in such statements. Past performance is not necessarily indicative of future results.

Related Content

Valar’s AI-derived biomarker is a game-changer for treating pancreatic cancer

DCVC DTOR 2025: One overlooked source of clean water is polluted water