DCVC V

When we started DCVC almost a decade ago, one of the pressing Deep Tech problems of the day was scale-out compute. Our firm played a role in creating some of the most important computing resources taken for granted today. Many of our team’s early investments became the building blocks of today’s computing giants including AWS, Microsoft Azure, Google Cloud, Illumina, and VMware. They also, in a very material way, enabled the large-scale machine-learning and AI capabilities upon which people are building the future.

Our early role has consistently given us unique access to scientists and engineers using these computing “superpowers” to attack previously insurmountable problems far beyond IT. We saw that their solutions could upend — and were in fact already disrupting — global industries. Consequently, we believe the current Deep Tech opportunity is both immense and impactful, even relative to prior incarnations.

DCVC V — $725 million focused on a $20+ Trillion GDP Opportunity[1]

We are grateful that our success to date enabled us to close DCVC V, a new $725 million Deep Tech fund, our eighth overall. DCVC V will continue to back early-stage Deep Tech teams as well as doubling down on key later stage opportunities as they emerge from within our portfolio. This fund, roughly twice the size of our prior vintage of funds, is one of the largest raises to date for Deep Tech.

We recognize that solving tough global challenges requires a deep bench of talented individuals. To support our new efforts, we continue to strengthen our team. First, we promoted Kelly Chen, a principal at DCVC with a strong track record and deep understanding of our investment thesis, to partner. Alan Cohen, formerly of Cisco, Nicira and Illumio, and Matt Michelsen, formerly an advisor to 8VC, have joined as partners, bringing with each of them multiple decades of hard-won experience. And Kate Reed joins us as VP of marketing and communications to help our companies tell their important stories.

Increasingly over the last decade, the companies we fund have addressed a broader spectrum of global GDP with each successive year. With DCVC V, we are largely focused on disruption in the $20+ trillion of GDP of the global economy, not incremental change in the $3 trillion IT sector. DCVC V exemplifies the shared belief of our LPs, our team, and our co-investors – that venture capital is an essential catalyst to validate, prove, and deliver new technologies that civilization now demands.

Business as usual is broken. We believe venture capital can actively help correct some of the excesses of capitalism while delivering strong returns. Venture capital can address many urgent global problems and turn them into profitable opportunities – while empowering more people, more equitably, than “stay the course.” Our experience shows that successfully tackling the hard, even terrifying, problems of the world, often in innovation-resistant industries, has potentially greater impact and returns than many would believe.

Backing the Next Great Industrial Giants

We back teams taking on the global economy’s hardest challenges with novel computational and engineering approaches. These innovative scientists, engineers and company builders are applying Deep Tech to create the next great industrial giants. And we’ve seen them do it – from rockets to robots, from molecular manufacturing™ to microbes, and from applied AI to autonomous systems.

Below are key sectors DCVC V is investing in:

Our portfolio companies are transforming unsustainable global manufacturing, relieving an overstressed global food supply, curing seemingly incurable diseases, defeating terrorists and criminals, and providing the tools and systems to massively accelerate human innovation overall. Just a few examples of these amazing companies include:

Pivot Bio – Displacing the $212 billion synthetic fertilizer industry with a microbial alternative that delivers higher crop yields, reduces dead zones from nitrogen run-off and limits environmental pollution to modernize farming and improve food harvests. In over 11,000 field trials, farmers using the microbes saw nearly a 17 bushel per acre advantage over those using only synthetic nitrogen fertilizer.

Planet – Satellite imaging and analytics company founded by ex-NASA employees, using over 150 of its satellites in orbit and powerful AI to image every square inch of the Earth’s surface every day, making global change visible, accessible and actionable.

Zymergen – The world’s first industrial scale Molecular Manufacturing™ company, uniting AI, robotic labs and proprietary insights into multiple classes of microorganisms to deliver novel products and materials at global customer scale.

Atomwise – Algorithmic drug and new product discovery for pharma and agriculture companies with novel AI for atom-by-atom chemistry. Atomwise screens more than 10 million compounds every day and their ‘AtomNet’ technology continues to outperform status quo technologies, identifying hit compounds up to 10,000X higher than the physical high-throughput screening methods it augments. They’ve closed over $6B in pharma deals in less than a year, more than any other AI company, and have participated in multiple tropical disease collaborations.

Rocket Lab – Leading light capacity (sub-200kg) rocket startup. With multiple satellites successfully launched to orbit, delivers a range of complete rocket systems and technologies for fast and low-cost payload deployment. Recently launched seven small satellites to low-Earth orbit on the company’s seventh flight. Rocket Lab plans to launch once per week at scale.

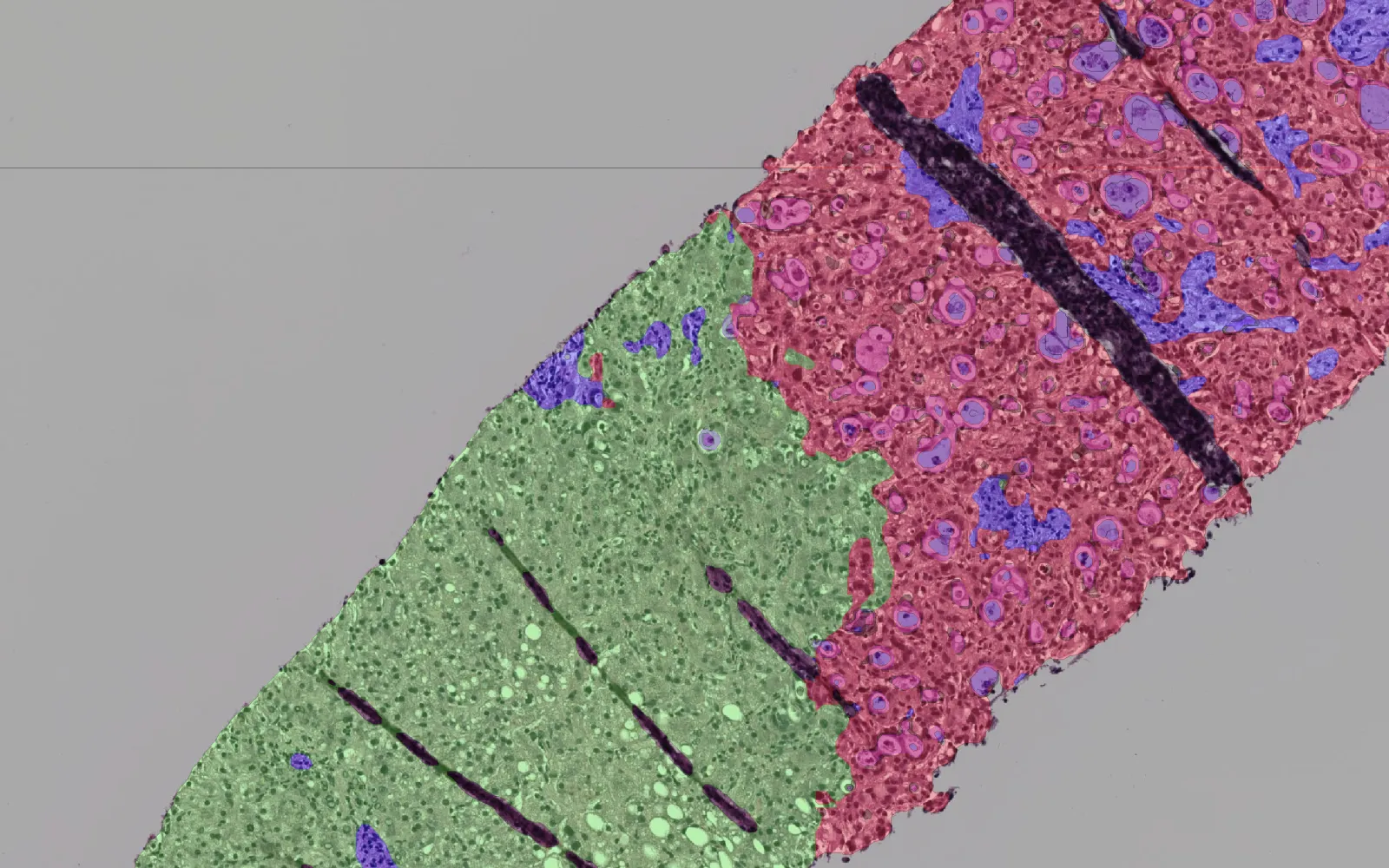

Recursion Pharmaceuticals – Enabling drug discovery through large-scale mathematical modeling, applying breakthrough AI and computer vision to understand the behavior of millions of human cells in parallel, every hour, every day. Have multiple, FDA-cleared investigational new drug (IND) applications underway, as well as a partnership with Takeda to evaluate and identify novel preclinical candidates for rare diseases.

Embark – Leading autonomous trucking company. Embark transforms the safety, efficiency and costs of the $1 trillion global long-haul trucking market with autonomous trucks capable of reasoning their way along the roads like human drivers, no expensive and laborious pre-mapping required.

The world’s problems are daunting. But we truly believe, based on our experience and past success, that venture capital can address many of these urgent challenges, profitably and equitably. And we are excited to continue to create meaningful outcomes with DCVC V. Come join us!

[1] GDP opportunity based on data from the World Bank World Development Indicators, found here.

Related Content

Deep Tech Opportunity: Water offsets are giving big water users a responsible way to keep growing

Valar’s AI-derived biomarker is a game-changer for treating pancreatic cancer