DCVC 2025 Q4 update

Greetings, friends of DCVC, and Happy New Year!

It was an intense, productive end to 2025. In the news highlights below, you’ll see that DCVC portfolio companies raised nearly $2 billion in Q4 — signaling progress against relevant milestones and the ability to maintain momentum.

A few pairings of these companies (with most recent raise amount in brackets) underscore some of our present investment priorities:

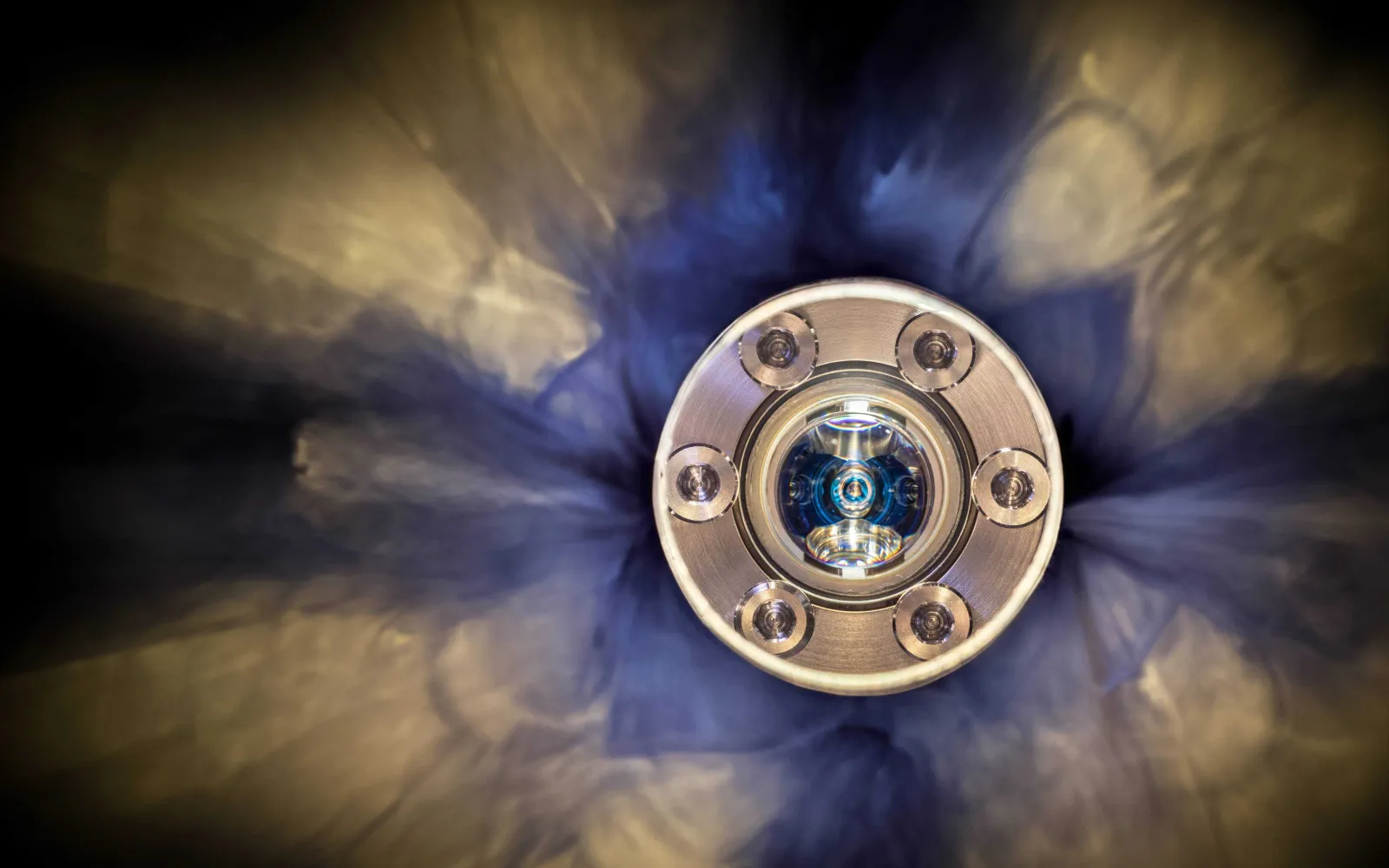

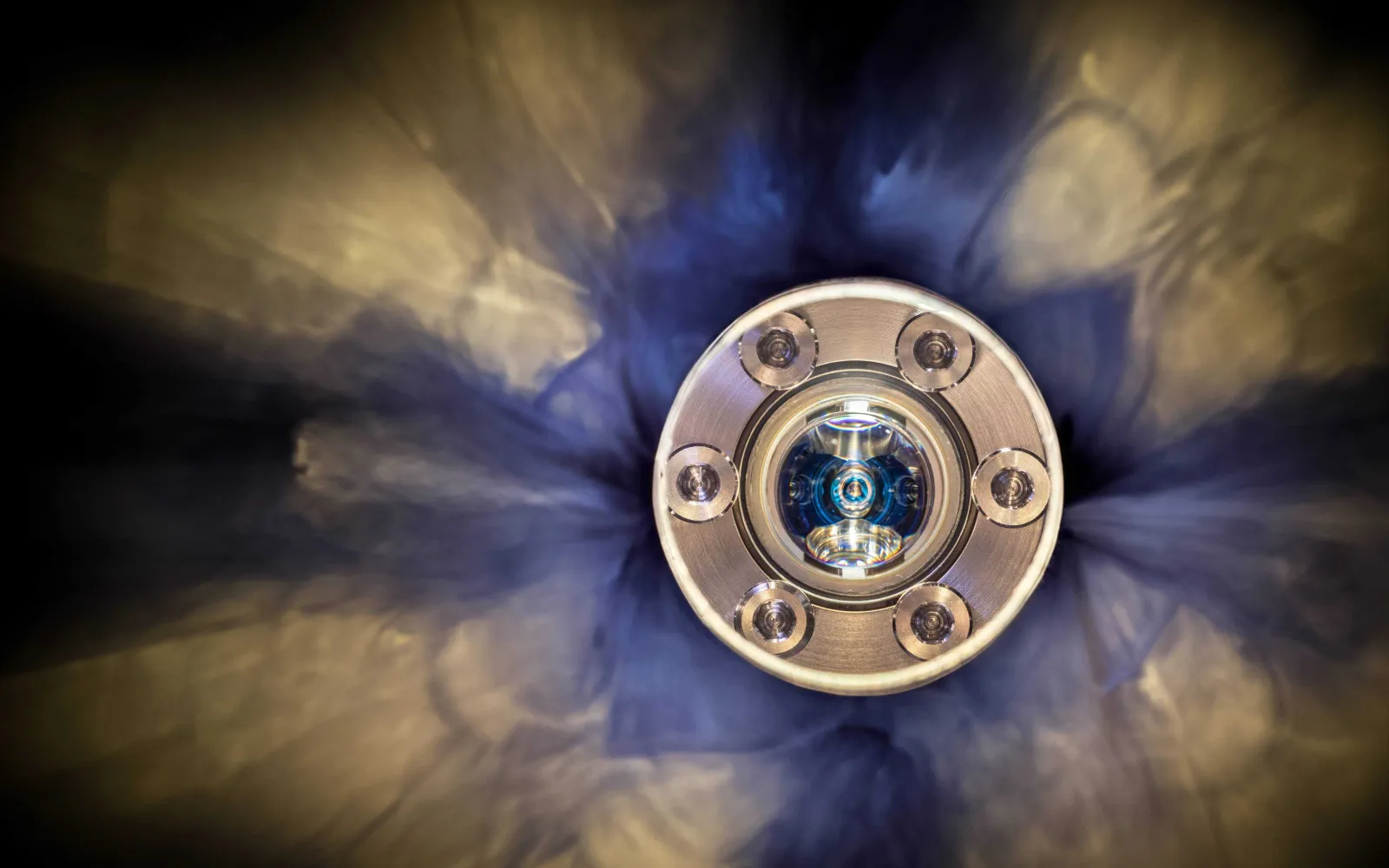

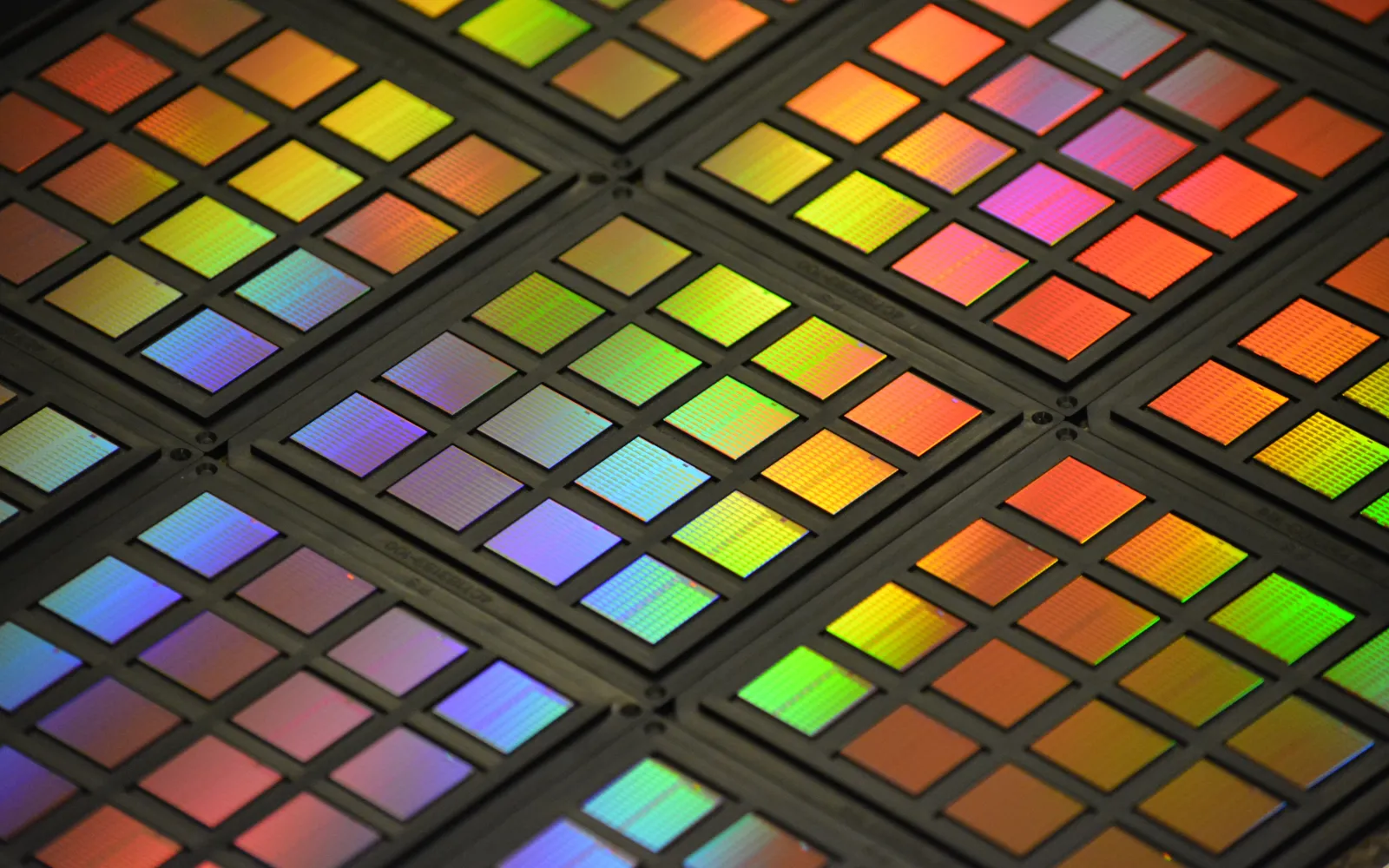

- Mythic [$125M] (analog compute 100X more power-efficient than Nvidia’s architecture) and Unconventional [$475M] (Naveen Rao’s NewCo, for a radically more power-efficient reinvention of the computer) represent a complete rethink of compute in an age of ruinous AI energy consumption.

- Fervo [$462M] (the world’s leading advanced geothermal company) and Radiant [$300M] (whose 1‑MWe SMR will be the first new nuclear design to be tested at Idaho National Lab’s new DOME facility) destroy the debate about climate resilience vs. energy abundance, because they are on the path to provide both, profitably and without subsidy.

- SF Compute [$40M] (maker of a market for buying and selling short-term contracts on compute/GPU hours) and ElectronX [$30M] (maker of an exchange for electricity derivatives) bring desperately needed, societally beneficial liquidity to the markets that matter most for compute and the power it consumes.

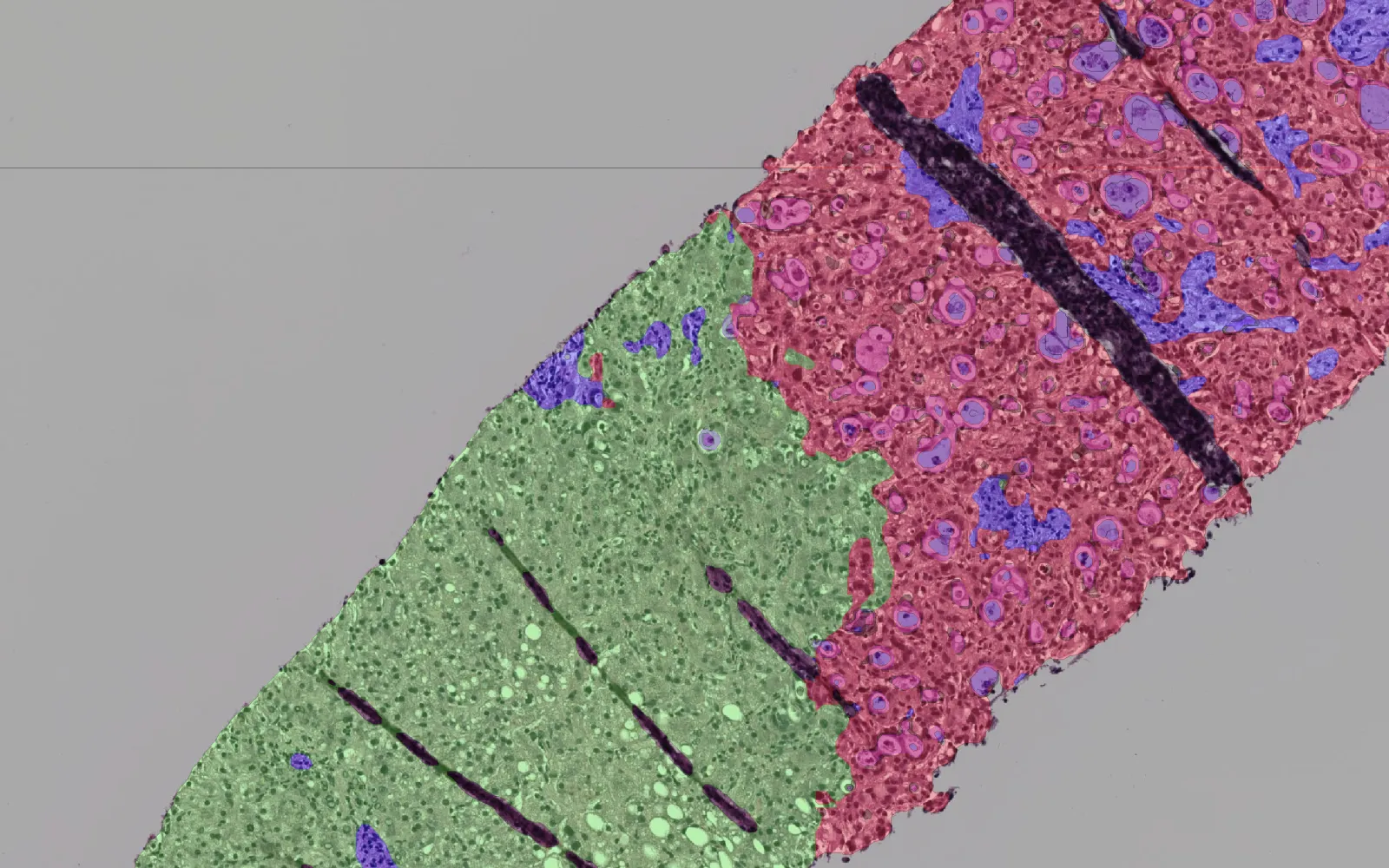

- Nilo Therapeutics [$101M] (which offers a way to treat autoimmune and inflammatory diseases without broad immunosuppression) and Relation Therapeutics [$26M] (TechBio’s leader, with billions of dollars in deals with the leading pharmas) are getting down to the essence of biology in order to make better medicine.

The binding agent across these and all the other companies in our portfolio is deep tech: an insistence that fundamental insight can build industry-leading businesses.

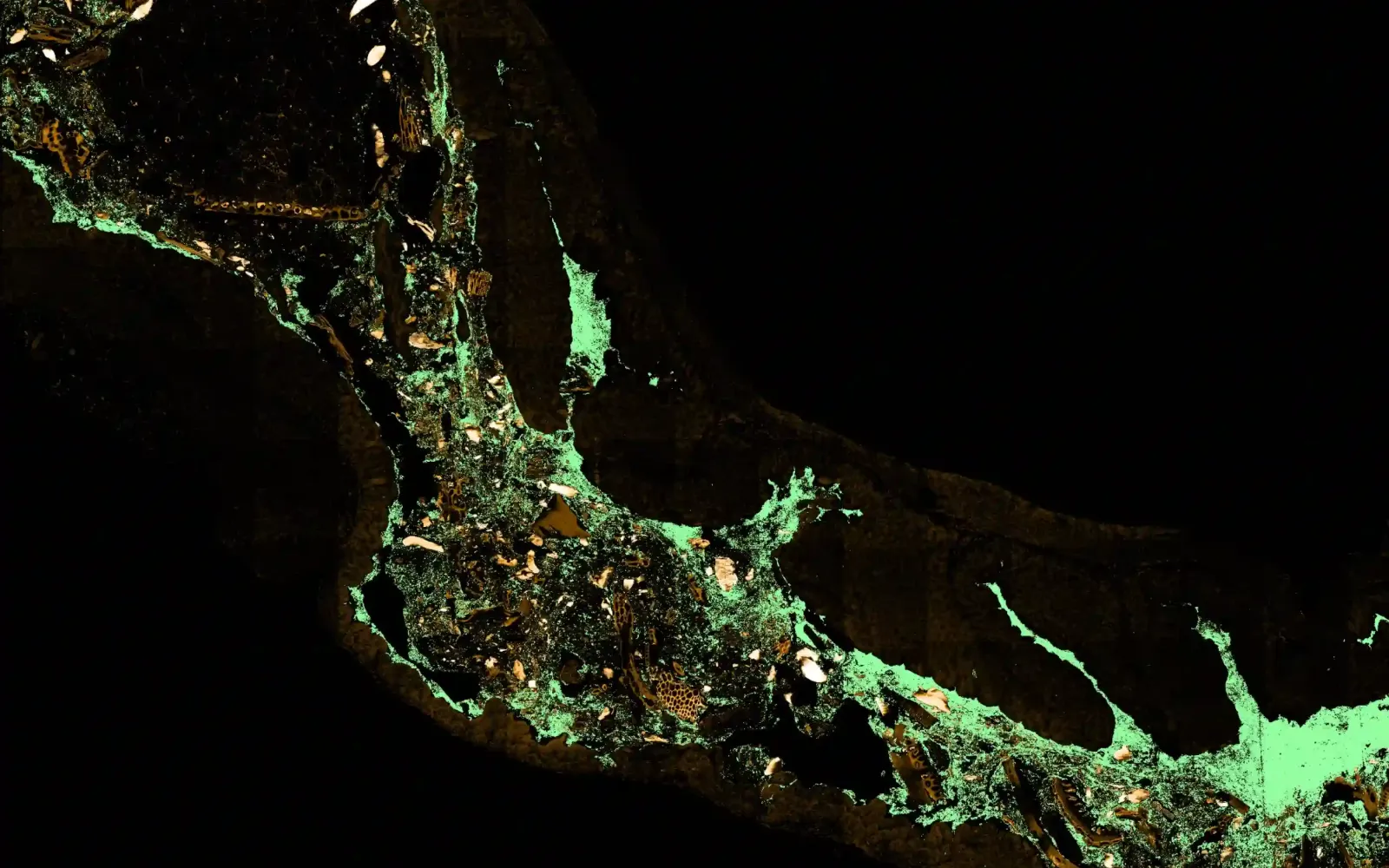

Nowhere is that spirit more alive than in quantum, a space we’ve been investing in since its infancy, and that we’re doubling down on right now. Directly below, you’ll see a blog post that lays out our present thinking. TLDR: this deepest of deep tech has us digging in.

We wish you a wonderful start to 2026!

Featured content

Why Kanvas built its own production line for microbiome therapeutics

Mythic raises $125M to break through AI’s power wall

Relation unveils atopic diseases agreement with Novartis—$55 million up front and up to $1.7 billion in milestone-based payments; DCVC, NVIDIA NVentures, and Magnetic Ventures co-lead $26M fundraise

FUNDING HIGHLIGHTS

DCVC Flagship & DCVC Climate

Curative raised a $150 million Series B round (in which DCVC participated) to scale a new model for health insurance.

ElectronX closed a $30 million Series A round, led by DCVC, to develop and operate the first U.S.-regulated, direct-access power derivatives market

Fervo Energy raised a $462 million Series E funding round, with participation from DCVC, to advance the development of its flagship Cape Station project in Utah and fund new enhanced geothermal developments across the Western U.S., accelerating enhanced geothermal technology as a major, dispatchable energy source.

Mythic raised $125 million, led by DCVC, to scale its analog compute architecture that is 100x more energy-efficient than the GPUs we’re all dependent on today.

OraLiva announced its $2 million Seed round, joined by DCVC, to support its mission of transforming early cancer detection through AI-powered cytology and precision microfluidics.

Radiant raised over $300 million, joined by DCVC, to support the scaling of commercialization efforts as the company prepares to break ground on its recently announced factory in Oak Ridge, TN.

Relation secured $26 million in new funding from DCVC, NVIDIA’s NVentures, and Magnetic Ventures to expand operations and R&D efforts, strengthening the base of its mission to discover the next generation of medicines using its AI platform and computation/experimentation/patient data synthesis, which is designed to reduce failure rates in drug development.

Remedy Robotics announced that it has raised $35 million in Seed (led by DCVC) and Series A funding to support the development of its remote robotic intervention system for stroke and cardiovascular care.

SF Compute raised $40 million in Series A funding, co-led by DCVC, to establish a marketplace that offers an instant offtake spot market for customers to buy and sell compute capacity by the hour, addressing bottlenecks in AI development.

Seneca launched publicly with $60 million in financing, joined by DCVC, to transform how the world combats wildfires using self-deploying, AI-powered craft equipped with fire suppressant.

Unconventional launched with $475 million in Seed funding, joined by DCVC, to reimagine the foundations of computing to bring brain-scale efficiency to AI by radically reducing energy use and democratizing control.

DCVC Bio

Nilo Therapeutics launched from stealth with $101 million in Series A financing, co-led by DCVC Bio, to establish labs and advance preclinical programs focused on harnessing neural circuits (via the vagus nerve) to restore immune homeostasis, offering a potential new way to treat autoimmune and inflammatory diseases without broad immunosuppression.

OTHER NEWS

DCVC Flagship & DCVC Climate

Agility Robotics announced a partnership with Mercado Libre to integrate Digit into a San Antonio facility, achieved a 100,000-tote milestone at a GXO Logistics facility, and was named to Bloomberg’s list of AI startups to watch in 2026 — demonstrating the adaptability, commercial viability, and expanding capabilities of Digit.

Brimstone unveiled its Rock Refinery roadmap to produce cement alongside critical minerals like aluminum and titanium from a single, abundant feedstock. This co-production model aims to cut costs by 40% and strengthen domestic supply chains, positioning Brimstone to disrupt a $2.4 trillion global materials market.

Fortem secured orders from U.S. allies in Europe and the Middle East for a dozen counter-drone systems, was selected for the U.S. Army’s new Global Tactical Edge Acquisition Directorate (G‑TEAD) Marketplace, and partnered with Southern States LLC to equip utilities with advanced, scalable solutions to detect, track, and respond to drone-related threats targeting critical grid infrastructure.

Fulfil announced its integration into Amazon’s new Whole Foods “store within a store,” validating Fulfil’s ability to bridge physical retail and rapid delivery, streamlining complex grocery fulfillment at scale.

Oklo secured DOE approval for the Nuclear Safety Design Agreement (NSDA) for its Aurora Fuel Fabrication Facility (A3F) — a pivotal step toward establishing the domestic fuel infrastructure necessary to scale its advanced nuclear reactor technology.

Proprio announced a partnership with Harms Study Group — a major step forward in quantitative, AI-driven spine surgery research.

Radiant announced its plans to build its R‑50 factory in Oak Ridge, TN, which aims to mass-produce 50 Kaleidos microreactors annually by 2028, moving portable nuclear power from concept to industrial reality.

Remedy Robotics completed the world’s first fully remote neurointerventional procedures — a major milestone in the democratization of lifesaving cardiovascular care.

Relation announced a new collaboration with Novartis — worth $55 million up front and up to $1.7 billion in milestone-based payments — to accelerate the discovery of drug targets for atopic diseases.

DCVC Bio

AgZen, maker of a smart spraying system used on ~1 million acres of farmland, announced a partnership with Corteva Agriscience (a major American pure-play agriculture company) to further explore the commercial potential of increasingly optimized crop inputs.

Empirico entered into a deal with GSK, worth $85 million in upfront payments and up to $660 million in success-based development, for an exclusive license to EMP-012, a Phase 1 siRNA oligonucleotide candidate for Chronic Obstructive Pulmonary Disease (COPD) and type 1 inflammation — substantial validation for a potential best-in-class treatment for these inflammatory respiratory diseases.

Latus Bio received IND clearance and Fast Track, Orphan Drug, and Rare Pediatric Disease designations from the FDA for its gene therapy candidate LTS-101, to treat the CNS manifestations of CLN2 disease — key regulatory steps toward comprehensively addressing incurable neurodegenerative disorders by finding a better way to deliver genes to cells deep in the brain.

Solu Therapeutics, a pioneer of novel therapies to eliminate disease-driving cells in cancer, immunology, and other therapeutic areas, announced that it would present details from its first-in-human Phase 1 clinical trial of STX-0712, its novel monotherapy for the treatment of chronic myelomonocytic leukemia and acute myeloid leukemia, at the American Society of Hematology Annual Meeting.

Totus announced (earlier in 2025) successful Phase 1 completion for TOS-358 (the first covalent PI3Ka inhibitor in clinical development), showing high target engagement, initial activity, and low toxicity. It also appointed a new Chief Medical Officer, Zelanna Goldberg, and a new CFO, Simon Harnest. The company previously announced a collaboration with Eli Lilly using Totus’s OmniDEL platform for drug discovery.

Umoja Biopharma’s UB-VV111 received FDA Fast Track designation for the treatment of relapsed/refractory B‑cell malignancies (cancers that resist standard treatments).

DCVC in the Media

How AI is transforming healthcare across the country

SF Compute, an AI Computing Marketplace, Raises $40 Million

From Waste-to-Wing: Sustainable Jet Fuel Developers Tap Landfills, Wastewater Plants, and Dairy Farms for Feedstock

Novartis Strikes Deal With UK Biotech for Up To $1.7 Billion

Mythic’s analog architecture is the kind of breakthrough that wins technology races: not more resources, but smarter, more elegant engineering. It gives America and its allies an edge that no amount of electricity can buy.”

Matt Ocko on Mythic’s $125 million raise, toward challenging Nvidia

Related Content

Deep Tech Opportunity: Water offsets are giving big water users a responsible way to keep growing

Valar’s AI-derived biomarker is a game-changer for treating pancreatic cancer

DCVC DTOR 2025: One overlooked source of clean water is polluted water